A bearish ABCD pattern has formed on the H1 chart of the S&P 500 index . A sell position can be opened after a downward reversal of the prices from point D. Stop Loss is set just above point D, and Take Profit is set at points C, A, and below if the price has a strong downtrend.

This lets you be ready for breakouts without having to watch every tick. Alerts can be a great aid if you don’t have time to watch the market all day. Or they can help avoid the temptation to jump in early. Also, the time to complete retracements A and B should be equal. Update it to the latest version or try another one for a safer, more comfortable and productive trading experience.

A prudent use of leverage is advised when trading ABCD trend-following or reversal strategies. Also, positive risk vs reward ratios may be applied by aligning stop losses and profit targets according to the periodic highs or lows included in the pattern. Bearish ABCD patternTo take positions, traders wait for the pattern to complete, then go long or short at point D. In the bullish version, traders buy at D, while in the bearish version, traders sell at D.

How much higher would they be if you only lost half as frequently? Most traders focus on chasing profits and forget that minimizing losses can have the same net impact on your bottom line…. The Head and Shoulders pattern is a trend reversal indicator that predicts bullish to bearish and bearish to bullish reversals in the forex market. Top Pullback Trading StrategiesPullback trading strategies provide traders with ideal entry points to trade along with the existing trend.

Ready to trade at

A currency either has high volatility or low volatility depending on how much its value deviates from its average value. There is no higher point above C in the C to D move, and no point is lower than D. Get to know us, check out our reviews and trade with Australia’s most loved broker. All legal rights of publications hosted on this website are protected by the international intellectual property legislations. Using any audio, video, and text materials is permitted only if there is a direct link to source materials.

But despite a https://forex-trend.net/ing direction, it can be difficult to establish support levels in these stocks. Day trading is all about recognizing patterns in stock charts, and no concept is more important for new traders to learn than ABCD pattern trading. This pattern appears frequently in stock charts and is easy to spot once you know what you’re looking for. More importantly, it can help you time your buying and selling more effectively. It can also instill confidence in your trading decisions. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders.

Keep reading to learn more about the ABCD pattern and how to apply it to your own trading strategy. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Like most types of technical analysis, the ABCD pattern works best when used together with other chart patterns or technical indicators.

By using indicators like Fibonnaci extensions and retracement… The best way to scan for abcd patterns is to look for intraday momentum. Often times, right after the market opens, you’ll find stocks that are trending upward or downward.

It is characterized by two ascending or descending trend lines that are parallel to each other. This will help you take profits off the table when the market moves in your favor. For example, you can use a trailing stop loss to lock in profits as the market moves in your favor. The final leg, D, should be equal to the initial AB move.

Investors are interested in safe assets that favour the US currency, but how long this will last is an open question. When trading with the ABCD pattern, there are a few things that you need to keep in mind. B – The end of the first leg which is marked by a significant swing high. We use the information you provide to contact you about your membership with us and to provide you with relevant content.

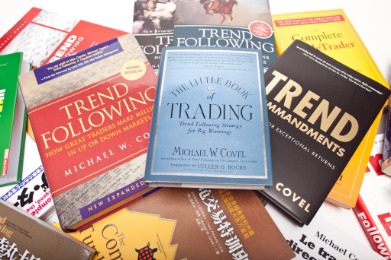

The ABCD price action pattern is a price and time-related technical analysis tool that was originally noted by H.M. Gartley, a technical analyst primarily known for the more complex pattern named after him, the Gartley pattern. The best apps for stock charts support a wide range of technical analysis features like charts, pattern recognition and drawing tools. The ABCD pattern is a fairly simple harmonic pattern based on Fibonacci ratios. Trading on it is relevant for different financial markets.

First, the https://en.forexbrokerslist.site/ formation consists of three consecutive price swings. A bullish pattern has a down, up, and down movement again. A bearish ABCD pattern has up, down, and up price swings. Chart patterns Understand how to read the charts like a pro trader. In these circumstances, an investor will wait too long or jump too soon, thereby missing out on the top-end of the stock’s profit-making capabilities.

Tips for trading the ABCD Pattern

We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. The ABCD pattern, though varied, is one of the most reliable and established patterns in trading. It can be used for investments in both bearish and bullish trends and gives the information necessary to avoid heavy losses.

We’ve written extensively about bullish candlestick patterns and bearish candlestick patterns, so be sure to check those links out. Another school of thought connects the middle of the trend. You can see in this next image that we have connected the middle of the B to C pullback instead of the high and low. Traders of the harmonic pattern might look for price reversal at point D, to trade with the expectation of a short term rebound on the index.

- The bearish pattern begins with a strong upward move – initial spike , during which buyers are aggressively buying thus pushing the stock price to it high-of-day.

- Browse frequently asked questions about our platform.

- Check off all the boxes of your trading checklist before trading a stock.

- With that in mind, let’s see two examples of the ABCD pattern – bullish and bearish.

- Top Pullback Trading StrategiesPullback trading strategies provide traders with ideal entry points to trade along with the existing trend.

The bullish version of the pattern, which signals the end of an existing downtrend, is simply the bearish version flipped upside down. The knowledge and experience he has acquired constitute his own approach to analyzing assets, which he is happy to share with the listeners of RoboForex webinars. The ABCD pattern is a great tool to use in trading as it can provide us with a clear and concise view of the market. However, it’s not just the technical aspects of the pattern that make it so useful. The psychology behind the pattern is also important to understand.

Traders may interpret this as a sign to move to a larger timeframe in which the pattern does fit within this range to check for trend/Fibonacci convergence. Convergence of several patterns—within the same timeframe, or across multiple timeframes–provide a stronger trade signal. At this point, we are going to explain a more simplified version of the ABCD pattern that actually works in the market.

A second disadvantage stems from the fact that stock price moves are rarely as neat and precise as those shown in our images of the ABCD pattern. Therefore, the price movement within the pattern may vary a bit, making it harder to identify. The initial price swing moves upward from point A, a swing low, to a high intraday price marked as point B. The retracement, C, should be between 38.2% to 61.8% of the AB move.

Thus, the pattern has a favorable risk-reward ratio. A second advantage that the pattern offers is a trade entry with clearly defined and limited risk. Running an initial stop-loss order just on the opposite side of point D gives traders the chance to take a low risk trade.

Take profit levels

Please ensure you https://topforexnews.org/ how this product works and whether you can afford to take the high risk of losing money. The bearish pattern begins with a strong upward move – initial spike , during which buyers are aggressively buying thus pushing the stock price to it high-of-day. Inevitably, buyers start to sell their shares in order to take profits. Therefore, we end up seeing the spike, followed by a healthy pullback.

Immediately I showed the options for working on a coin, so as not to spam trading ideas and spend time… The Ichimoku Kinko Hyo indicator provides traders with the market’s current momentum, direction and trend strength. How to Use DeMarker Indicator For Forex TradingEvery trader needs to know precisely when to enter or exit a forex market. Our trading platform has transparency and reliability as its core principles, which helps you make efficient trades with accurate information and clear regulations.

The ABCD bearish version has three ascending price swings before a trend reversal occurs. At first, the pattern begins with a price increase from A to B. Trading Strategies Learn the most used Forex trading strategies to analyze the market to determine the best entry and exit points. In the ABCD pattern, each letter represents a significant high or low in the price shown in the stock graph, meaning that it is relatively easy to find and follow. Each pattern leg is usually within a range of 3-13 bars/candles.

Setting Up the “Support and Resistance Based on 240 Bars” Trading Strategy

Generally, volume tends to be low while a stock is consolidating and you ought to consider this a red flag when using this pattern. So if you have a stop of 10 cents from your entry, you would want to make at least 20 cents or more in profit. For both versions, the lines AB and CD are called the legs while BC is known as the retracement or correction.